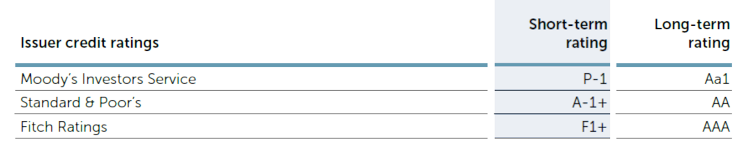

EAA-Rating

The EAA on the capital market

EAA is independent both economically and in terms of its organisation, this means, amongst other things, that it plans its refinancing itself and implements it with its own issues on the capital market. As a result of the liability commitments it has obtained, EAA enjoys very high creditworthiness.

EAA is today focused on large-volume bonds in EUR or USD with maturities of up to three years. Its annual issue volume in this segment currently stands at EUR 3 Billion. EAA offers maturities of up to one year with its commercial paper programme in USD, EUR and GBP.